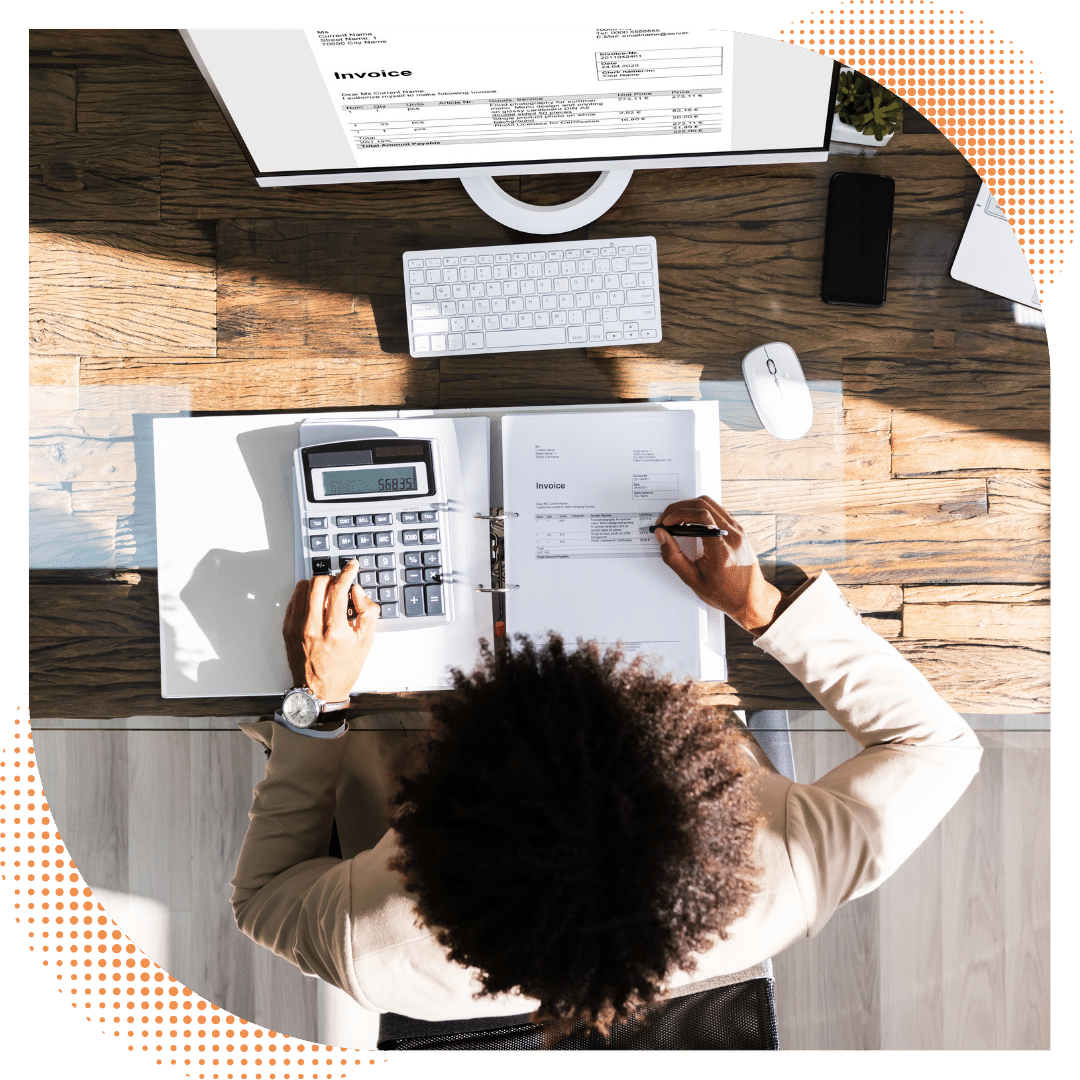

We get it, no one likes surprises when it comes to fees.

That's why we keep things simple with our no-nonsense fixed-fee packages. It's like ordering from a menu - you pick what you need, and we give you a fixed price. Easy!

But seriously, we understand that cash flow is important, especially for small businesses. That's why we let you spread the cost throughout the year. And, with our unlimited email and phone access to your dedicated accountant, you can ask all the questions you want without worrying about getting a surprise bill.

We've got some sample packages below, but keep in mind, the actual fees will depend on your unique business situation. Things like VAT status, industry, and how much bookkeeping you need will play a role. But hey, we get it - no two businesses are the same. So, at Effective Accounting, we're all about tailoring our support to perfectly fit your one-of-a-kind needs!

Contractors

(Our typical clients include: IT, Management, Financial, HR Contractors)

Leave the accounting and tax paperwork to us. We'll prepare and submit your Company Accounts to Companies House and your Company Accounts and Corporation Tax Return (CT600) to HMRC, ensuring your business stays compliant.

We'll ensure everything stays up-to-date and compliant by updating your company address and directors' details as required, as well as preparing and submitting your annual Confirmation Statement to Companies House.

As part of our services, we're happy to offer you the use of our office address as your company's Registered Office address.

We'll make sure that your personal tax affairs are in order, giving you the peace of mind to focus on your business.

We'll take care of preparing and submitting your company's VAT Returns. We'll also conduct a review of the VAT claimed on expenses to ensure that your VAT input claim is optimised, helping you save money where possible.

We offer comprehensive payroll services for your company, reporting salaries taken by the director(s) and/or spouse. We'll take care of all the necessary reporting and compliance requirements, leaving you free to focus on growing your business. Please note that additional fees may apply for additional employees.

With our fully-managed bookkeeping service, we'll keep track of all your business transactions, including sales and expenses, and reconcile them with your company bank transactions. We use Xero software to manage your bookkeeping needs, ensuring that everything is kept up-to-date and compliant.

We'll provide you with access to the award-winning Xero Software, widely regarded as one of the most user-friendly accounting software packages available today. With Xero, you'll have all the tools you need to manage your finances with ease, making it the best choice for your business.

We offer access to Dext Software as part of our packages, a powerful tool that lets you easily upload and digitally store all your purchase invoices and receipts. It streamlines expense tracking and simplifies accounting, all while keeping records organised and secure.

We provide Tax Enquiry Cover, also known as Fee Protection, to give you peace of mind in the event of a tax enquiry. With this cover, you won't be charged any additional fees by us, and any costs associated with the enquiry will be claimed under our practice-wide insurance policy.

You'll have unlimited access to your own dedicated Client Manager for support and ad-hoc queries throughout the year. Our friendly and knowledgeable team is always here to answer any questions you may have and provide expert guidance whenever you need it.

Typical Fee*

£145.75 + VAT (VAT Registered)

or £123.25 + VAT (non-VAT Registered)

Interested in joining us?

Small Businesses

(Our typical clients include: Film and TV Crew, Photographers, Tech start-ups and more)

Leave the accounting and tax paperwork to us. We'll prepare and submit your Company Accounts to Companies House and your Company Accounts and Corporation Tax Return (CT600) to HMRC, ensuring your business stays compliant.

We'll ensure everything stays up-to-date and compliant by updating your company address and directors' details as required, as well as preparing and submitting your annual Confirmation Statement to Companies House.

As part of our services, we're happy to offer you the use of our office address as your company's Registered Office address.

We'll make sure that your personal tax affairs are in order, giving you the peace of mind to focus on your business.

We'll take care of preparing and submitting your company's VAT Returns. We'll also conduct a review of the VAT claimed on expenses to ensure that your VAT input claim is optimised, helping you save money where possible.

We offer comprehensive payroll services for your company, reporting salaries taken by the director(s) and/or spouse. We'll take care of all the necessary reporting and compliance requirements, leaving you free to focus on growing your business. Please note that additional fees may apply for additional employees.

With our fully-managed bookkeeping service, we'll keep track of all your business transactions, including sales and expenses, and reconcile them with your company bank transactions. We use Xero software to manage your bookkeeping needs, ensuring that everything is kept up-to-date and compliant.

We'll provide you with access to the award-winning Xero Software, widely regarded as one of the most user-friendly accounting software packages available today. With Xero, you'll have all the tools you need to manage your finances with ease, making it the best choice for your business.

We offer access to Dext Software as part of our packages, a powerful tool that lets you easily upload and digitally store all your purchase invoices and receipts. It streamlines expense tracking and simplifies accounting, all while keeping records organised and secure.

We provide Tax Enquiry Cover, also known as Fee Protection, to give you peace of mind in the event of a tax enquiry. With this cover, you won't be charged any additional fees by us, and any costs associated with the enquiry will be claimed under our practice-wide insurance policy.

You'll have unlimited access to your own dedicated Client Manager for support and ad-hoc queries throughout the year. Our friendly and knowledgeable team is always here to answer any questions you may have and provide expert guidance whenever you need it.

Typical Fee*

£157 + VAT (VAT Registered)

or £134.50 + VAT (non-VAT Registered)

Interested in joining us?

Landlords

(With property owned through a Limited Company)

Leave the accounting and tax paperwork to us. We'll prepare and submit your Company Accounts to Companies House and your Company Accounts and Corporation Tax Return (CT600) to HMRC, ensuring your business stays compliant.

We'll ensure everything stays up-to-date and compliant by updating your company address and directors' details as required, as well as preparing and submitting your annual Confirmation Statement to Companies House.

As part of our services, we're happy to offer you the use of our office address as your company's Registered Office address.

We'll make sure that your personal tax affairs are in order, giving you the peace of mind to focus on your business.

We provide Tax Enquiry Cover, also known as Fee Protection, to give you peace of mind in the event of a tax enquiry. With this cover, you won't be charged any additional fees by us, and any costs associated with the enquiry will be claimed under our practice-wide insurance policy.

You'll have unlimited access to your own dedicated Client Manager for support and ad-hoc queries throughout the year. Our friendly and knowledgeable team is always here to answer any questions you may have and provide expert guidance whenever you need it.

Typical Fee*

£106.00 + VAT

Interested in joining us?

* Actual package costs will vary depending on business structure (sole-trader vs limited company, VAT status, business activity, staff numbers and Xero package).

FAQ's

We get it, questions can pop up anytime, and there's no such thing as a silly one. So, we've put together some of our most frequent questions to help you out.

Well, no one's twisting your arm, but it's a smart move. We can of course advise you on your accounts and tax for your current situation, but we love looking to the future with you and making sure your business will support you to achieve your dreams.

Nope, it's a breeze! We'll guide you through the process, making it as smooth and painless as possible.

It depends! Every client is different and we tailor our services to suit the client and their business. BUt we have provided a few examples and typical packages - see above!

Just click here to book in a chat with Nicola. You'll talk about your current situation, future plans, and some pesky paperwork (don’t worry, it doesn’t take too long). Then, you'll meet your Client Manager, who'll be your main point of contact for you and take care of your accounts like a champ!

Absolutely. After you’ve spoken with Nicola, she'll introduce you to your dedicated Client Manager – your new BFF in the accounting world.

If we don't float your boat or live up to your expectations, our contracts have a one-calendar-month notice period. We're not into clingy relationships! But we think you'll stay for the long-haul!

Nope. Our clients are spread across the UK - although we’d love to meet you if you’re ever in the area! Just shoot us an email or give us a call when you need us.

No, but your should! Our qualifications prove that we know our stuff and can give you top-notch advice. Going with an unqualified accountant is like hiring a cat to walk your dog – it's just not going to end well for anyone involved.

Nah, we're not about that life. We work with pre-agreed fixed fees, so no surprise bills will jump out at you. And with our packages, you get unlimited access to your Client Manager, so you don’t need to worry about being charged extra for calling with questions or emailing for advice!