Resources - Fact Sheets

We have prepared a number of fact sheets to assist you when setting up and running your business.

These are great for you to refer to, but are no substitute for personalised advice and expert support. Please get in touch for any assistance.

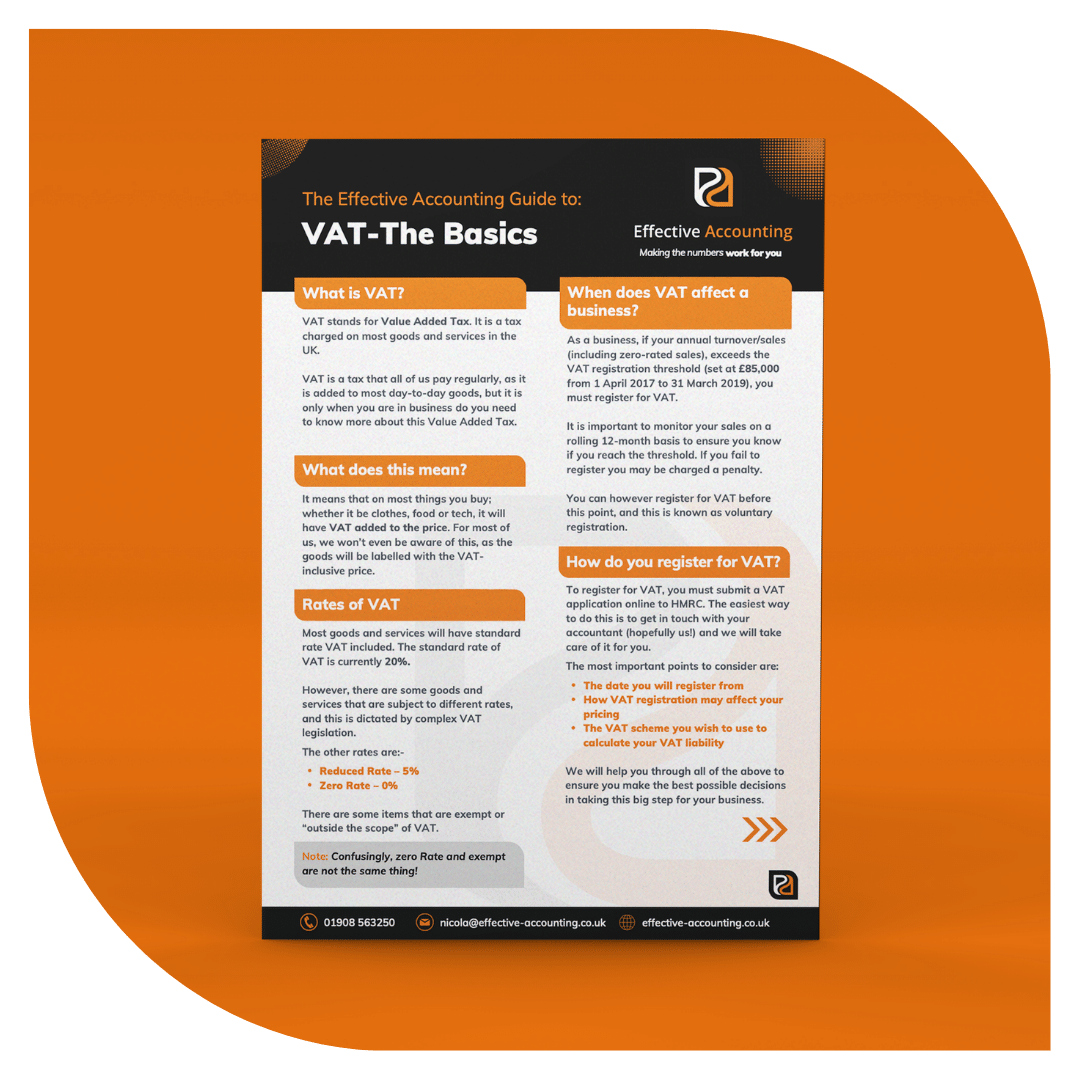

VAT - The Basics

A fact sheet covering the basics of VAT; what is it, when you need to register, and the deadlines involved.

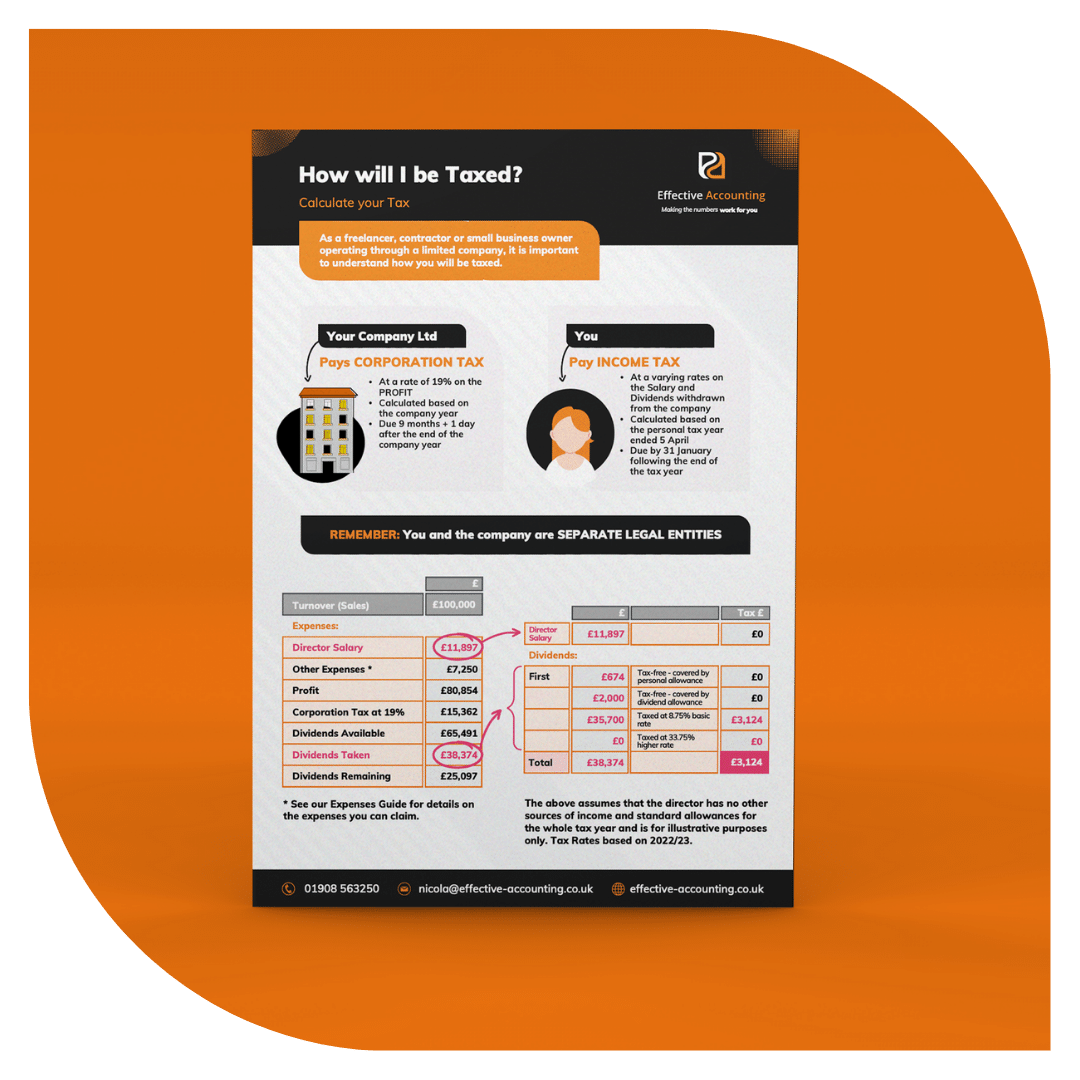

How a limited company

director is taxed.

An infographic showing how a limited company, and it's owner, will be taxed.

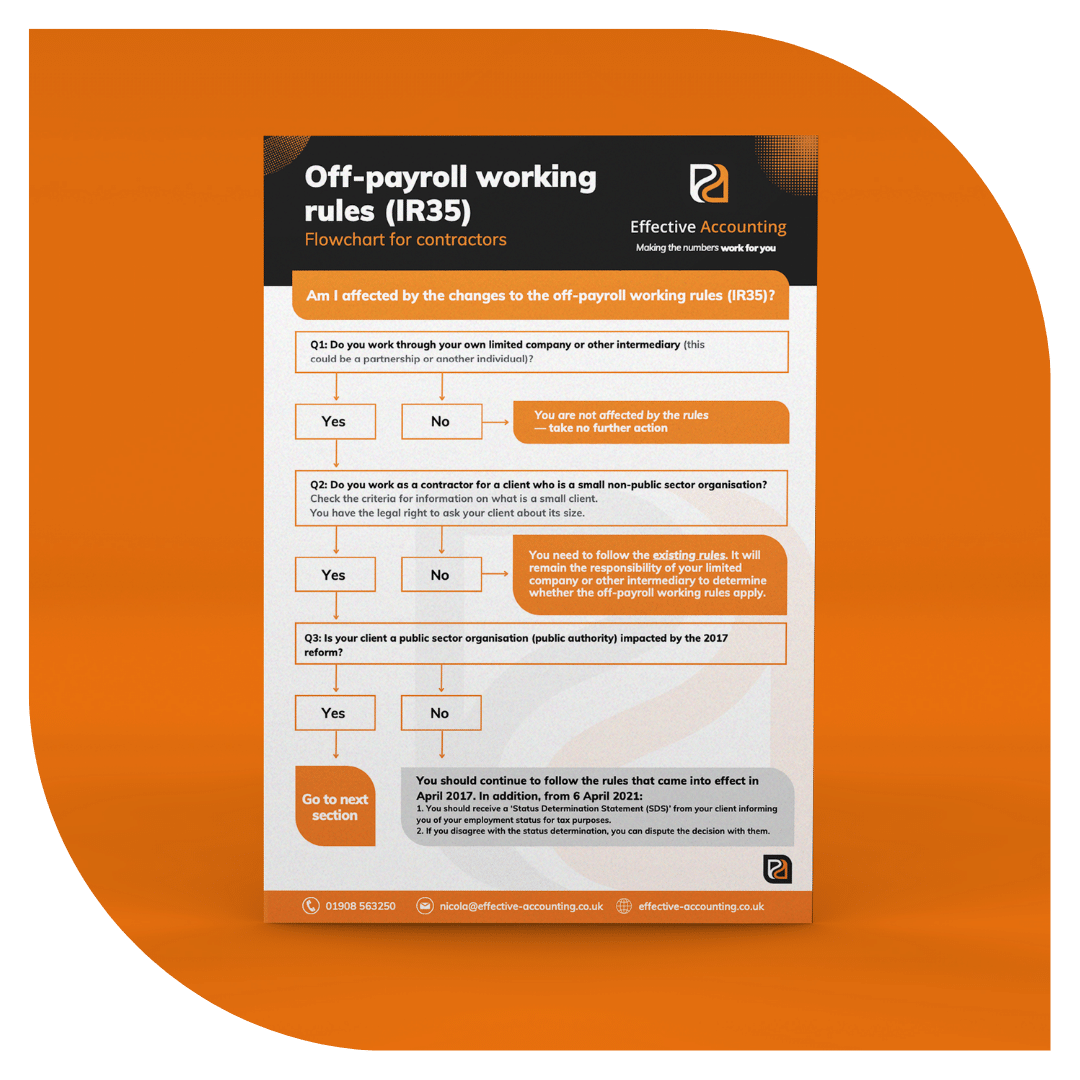

IR35 / Off-Payroll Working

Flowchart

A flowchart looking at whether you are impacted by IR35/Off-Payroll Working

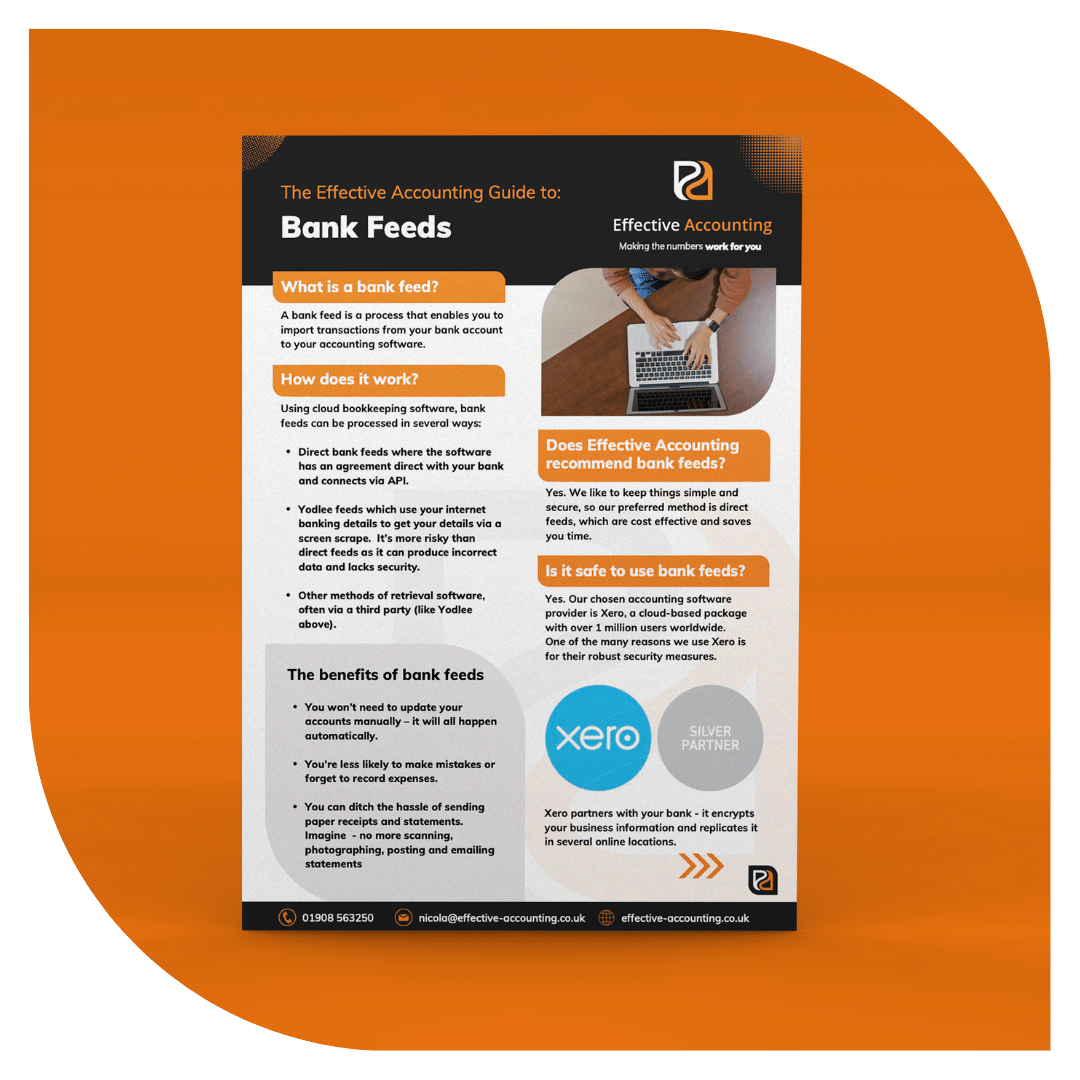

Bank Feeds

An explanation on bank feeds - what they are, and how they can assist you and your business.

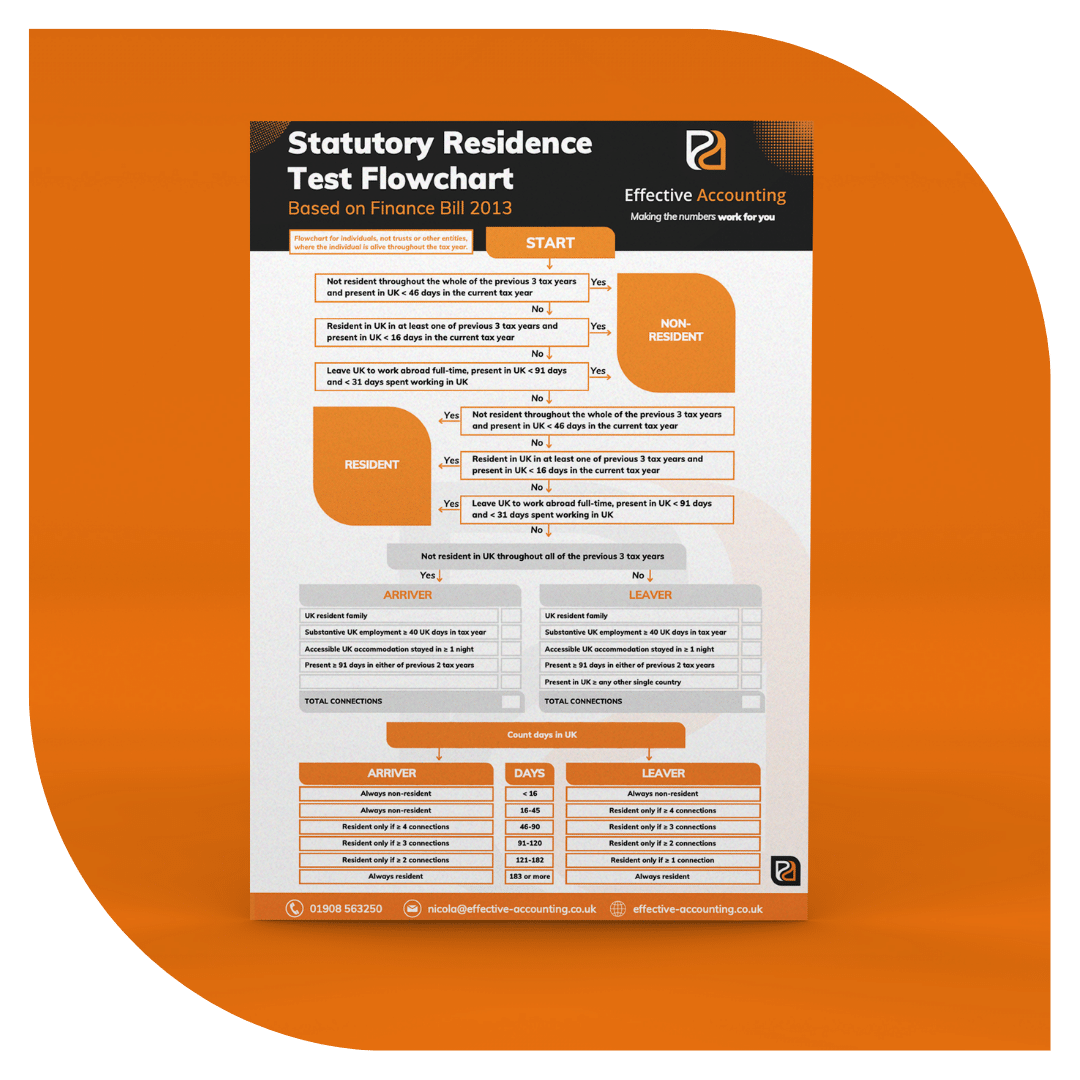

Statutory Residency Test Flowchart

A flowchart to help determine your Tax Residency Status